ISG Momentum® Market Trends & Insights Geography Report 2019

The outsourcing industry’s transition is continuing around the world, as clients everywhere are prioritizing the pursuit of new technologies, services and contract structures over traditional managed services. This approach often begins with tentative first steps. All the more so in the current environment of widespread caution about enterprise spending because of trade wars and economic uncertainty, a situation that is limiting outsourcing spending in most major markets. Clients continue to have more options for services, service providers and service delivery locations. Now ISG is seeing growing demand for consulting to make the right choices, and for management services to oversee outsourced operations.

Highlights

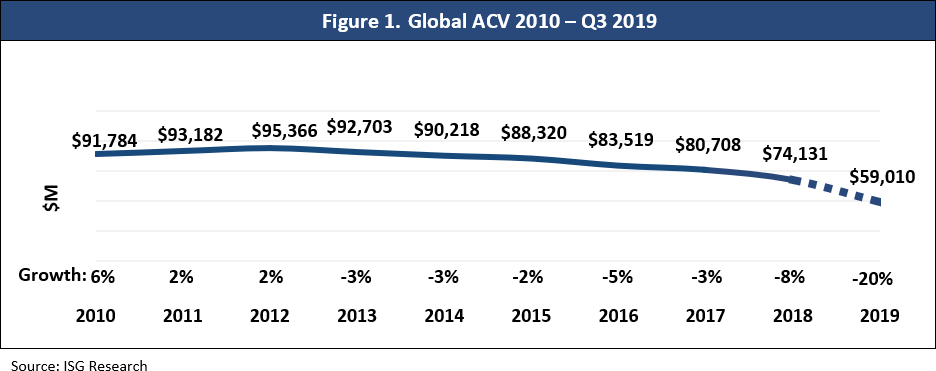

The number of outsourcing contracts signed continues to rise each year, but the cumulative annual contract value (ACV) of those deals continues to fall. The reasons for the long-term ACV decline results are well known: falling prices from commoditized service lines, aggressive pricing policies from new market entrants, and the increasing volume of proofs of concept and other small-scale projects that are often related to emerging technologies.

Global ACV fell for the sixth-consecutive year in 2018, and the 8 percent year-over-year decline was the largest in that span. The decline appears to be moderating and global ACV may grow in 2019; the $59.0 billion in ACV through the first three quarters of the year was 80 percent of the full-year 2018 total.

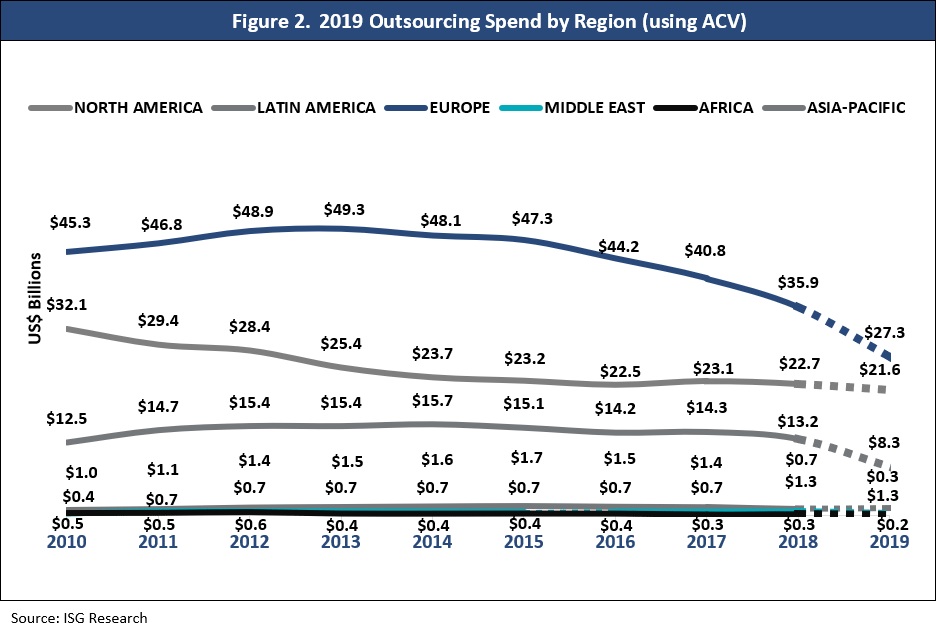

Every major region had a year-over-year ACV decline in 2018 and no region produced growth, although the Middle East and Africa did match their ACV totals from the prior year. In 2018, ACV fell most in the largest regional market, Europe, where the $35.9 billion in 2018 ACV was 12 percent less than a year earlier. North America declined just 1.7 percent and will almost certainly produce full-year growth in 2019. Europe will also return to growth if the ACV gain in the fourth quarter matches the total achieved in each of the first three. Through Q3 2019, Latin America had already surpassed its 2018 total. Asia Pacific ACV was behind the prior year’s pace.

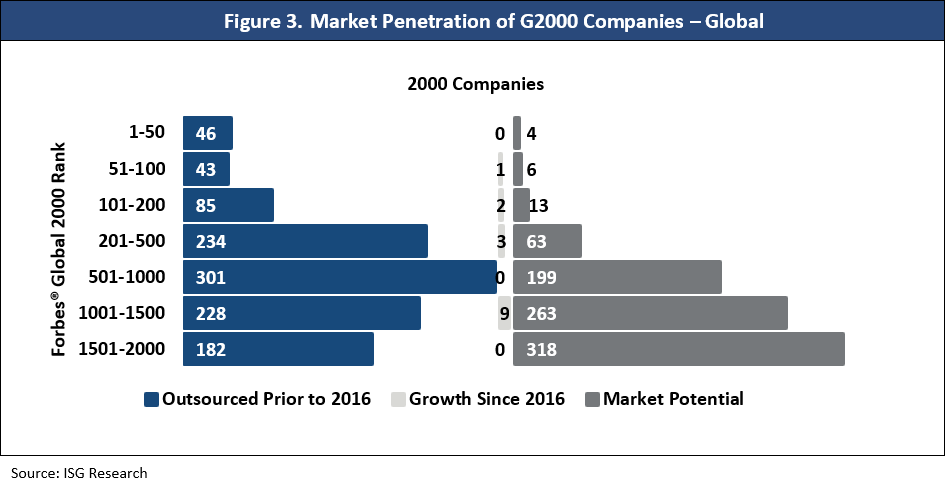

Figure 3 shows outsourcing penetration for each quartile of the Forbes® Global 2000 (G2000) ranking of the world’s largest public companies. The graphic shows the number of companies that have started outsourcing since 2016, and highlights that most new global outsourcing adoption has been by midmarket companies ranked between 1,001 and 1,500 in the G2000. Even after this adoption momentum, there is still considerable opportunity to win new clients in this segment, where 263 companies are still not outsourcing at a significant level.

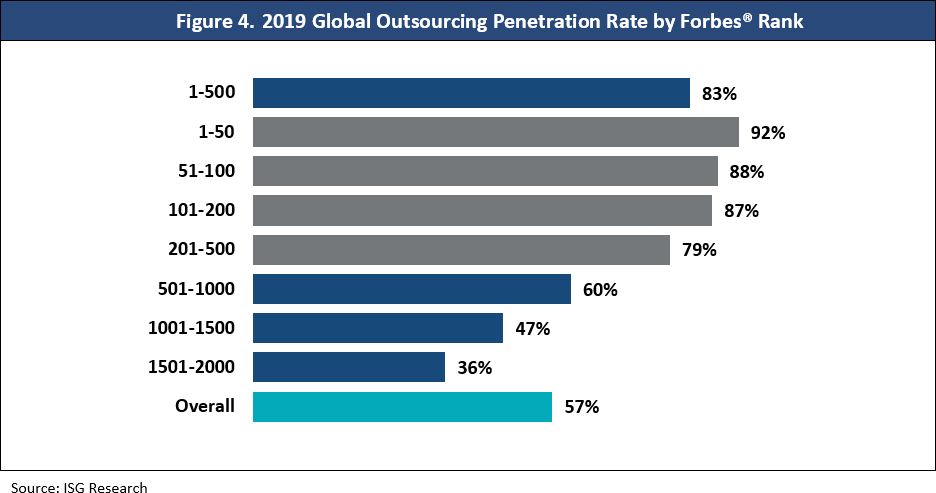

In 2019, 57 percent of all G2000 companies had at least one significant outsourcing contract. Figure 4 presents the overall outsourcing penetration rate and the penetration rates for each quartile of the G2000, with additional breakouts for the top 500 segment, where outsourcing adoption is still considerably higher than among smaller companies.

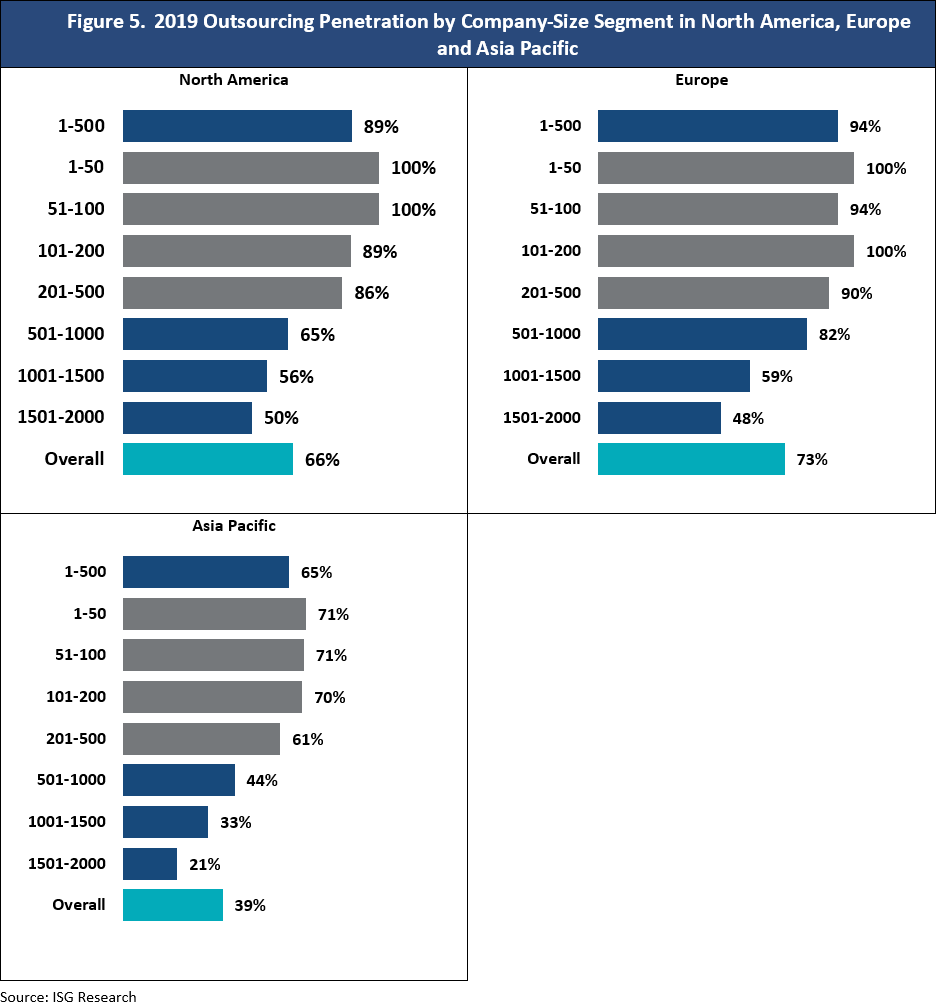

Overall and quartile penetration rates differ significantly across the three largest geographic markets — North America, Europe and Asia Pacific — which collectively account for approximately 97 percent of global ACV. For example, 82 percent of European companies ranked between 501 and 1,000 in the G2000 have adopted outsourcing, which is notably higher than the 65 percent rate in North America and nearly twice as high as the 44 percent rate in Asia Pacific.

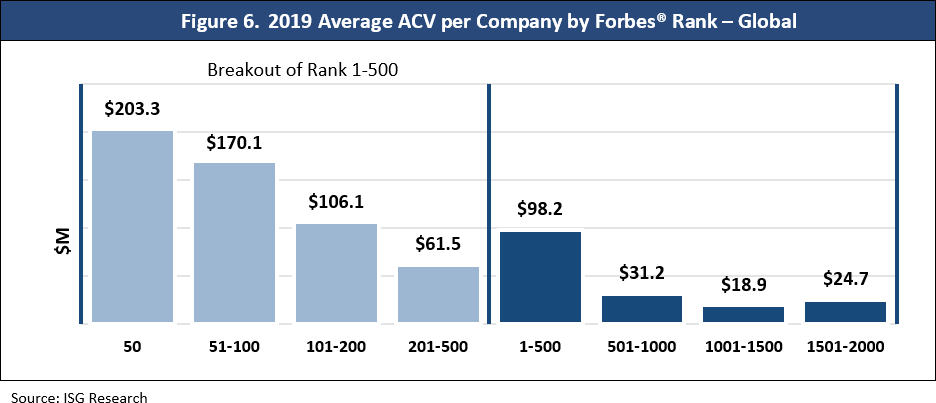

Average annual outsourcing spending generally correlates to company size. Clients ranked in the top 500 of the G2000 produce $98.2 million in average ACV, which is 3.1 times higher than the next client-size segment. In 2019, an exception developed to the size-spending correlation: the average client ranked 1,501 – 2,000 is now spending more ($24.7 million) than the average firm in the 1,001 – 1,500 segment ($18.9 million).

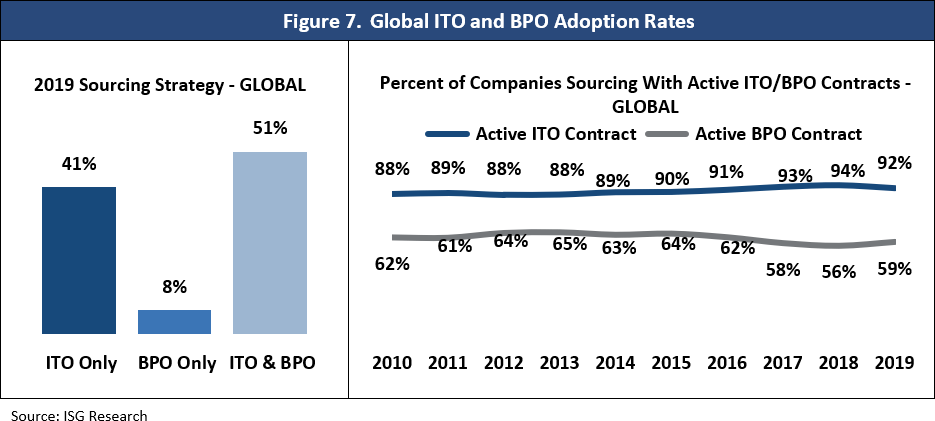

In another 2019 development, overall BPO adoption rose 2 percent while the ITO rate held study. The gain came in the BPO only segment; 8 percent of G2000 clients were contracting for BPO services in 2019 without contracting for any ITO, up from 6 percent the year before.

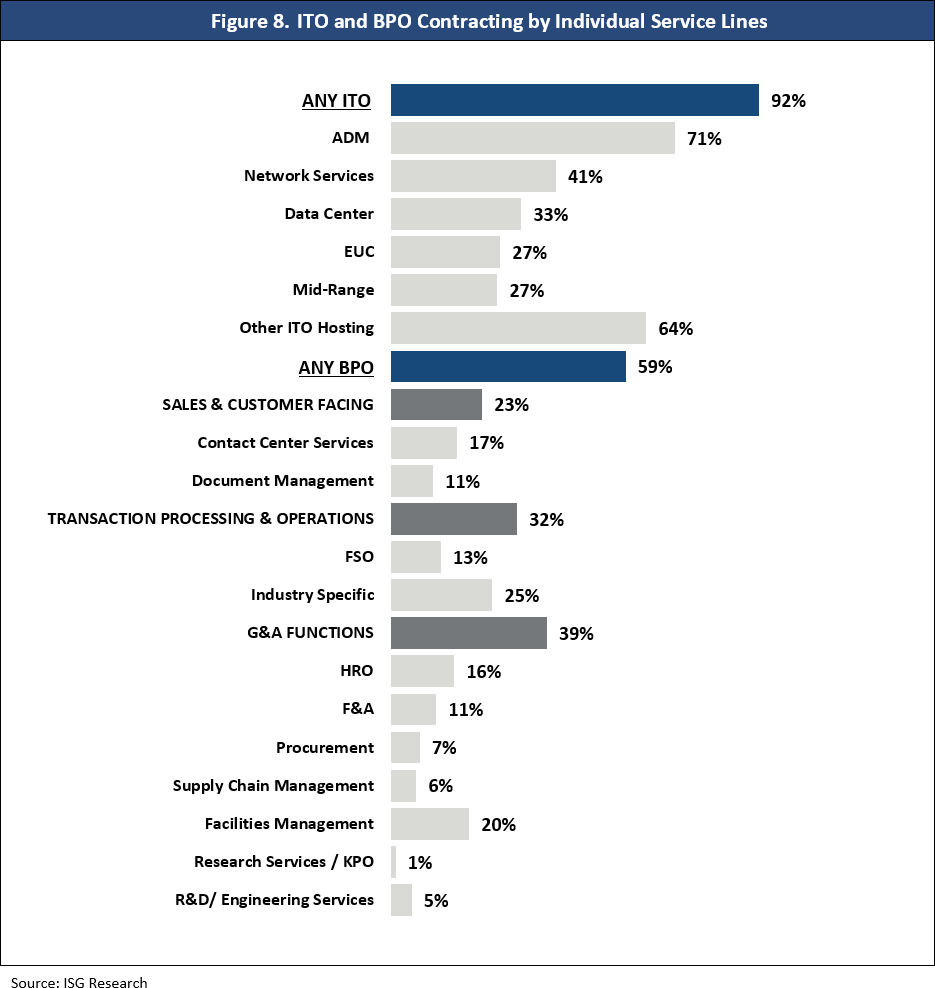

The overall penetration rates refer to clients using any ITO or BPO services. Figure 8 below shows client adoption of specific service lines. Application development & maintenance (ADM) is the most-outsourced service line and is contracted for by 71 percent of all ITO clients. Rising public cloud popularity has helped hosting services close the gap. It is the second-most outsourced service line and has been adopted by 64 percent of ITO clients.

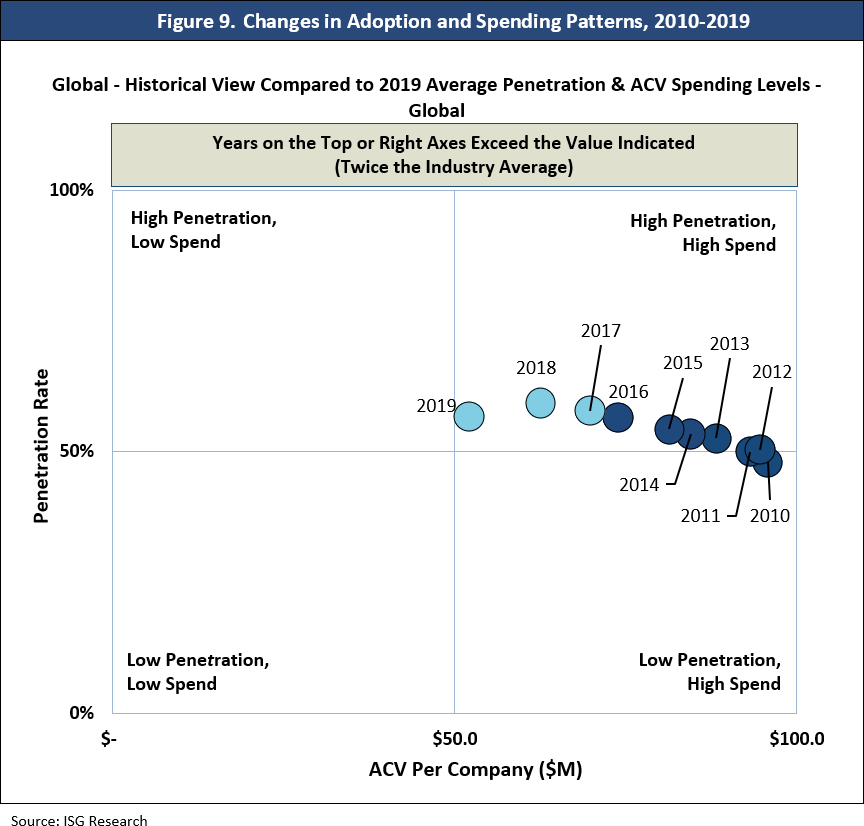

Figure 9 below presents a graphic representation of global outsourcing maturity over time. Outsourcing penetration has generally been rising over the last decade, but total spending has not kept pace. Those developments have moved the market from the high-penetration, high-spend quadrant toward the high-penetration, low-spend segment.

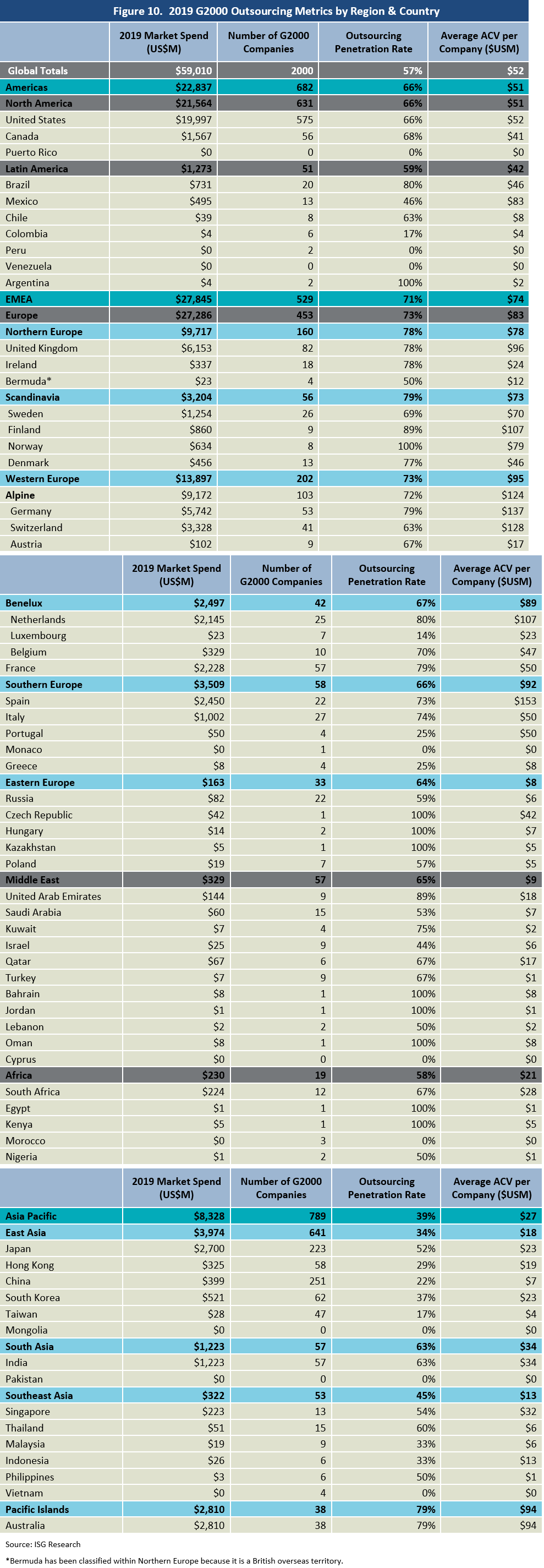

Figure 10 below presents 2019 ACV levels, Forbes® Global 2000 company totals, penetration rates and average per-company spending by region and for the leading countries in each region.

Summary of Key Findings

The individual country profiles include many country-specific developments that are influencing sourcing activity. The following summaries provide a broad-level overview of the findings.

North America

Despite the ongoing U.S.-China trade war, outsourcing spending in North America is gaining momentum and is likely to grow in 2019. U.S. companies are focusing on digital transformation to improve their current operations. Enterprises are also implementing agile and DevOps and are increasing their spending on cybersecurity. In Canada, many enterprises are outsourcing with an aim to modernize their portfolios and reinvent their operating models. There is also a rising trend among Canadian banks and public sector organizations to use more public cloud services.

Latin America

The Latin American outsourcing market is showing great potential in 2019. It produced a year-over-year increase in market spending (ACV) in just the first nine months of 2019, ending a three-year slump. Innovative technologies such as AI, automation, IoT and blockchain are gaining traction throughout the region. Mexico became the first country in Latin America to launch an AI strategy for harnessing artificial intelligence in sectors such as mobility, health, government, communication and agriculture. Costa Rica is the region’s top-ranked country on the Outsourcing Viability Index for Delivery Center Maturity, followed by Mexico and Colombia.

Europe

Outsourcing ACV was down across all major markets in 2018, and some were rebounding in 2019. With Germany on the brink of recession and the U.K. facing Brexit, the considerable uncertainty in Europe’s two largest markets makes it hard for the region as a whole to grow. Despite these impediments, Europe is home to many of the most promising sourcing markets. ISG continues to see strong demand for cloud-based services, with some late-adopter industries and public sector agencies now considering the cloud. There is also strong demand for robotic process automation, which companies are sometimes using to repatriate tasks that were previously outsourced.

Asia Pacific

Countries in the Asia Pacific region continue to serve the global demand for IT and BPO outsourcing services. But ISG observes that global companies are now emphasizing the quality of skills more than cost-effectiveness as an outsourcing driver. That development has helped Malaysia and Indonesia join India, the Philippines and China as preferred and leading service delivery locations. Outsourcing spending remained low among client companies in the Asia Pacific region and there were notable spending declines in the East Asian and Southeast Asian subregions, led by China and India. The Australian market ended a long year-over-year spending slump with a very high level of ACV in the first nine months of 2019.

Middle East

Economies in the Middle East are experiencing the headwinds coming from decelerating global growth. Outsourcing spending has declined significantly across the region and 2019 could produce the lowest level in a decade. The slowdown comes at a time when several Middle Eastern countries are focusing on moving away from their dependency on oil. For example, Saudi Arabia and the United Arab Emirates are improving their technology ecosystems by encouraging startups and investing in AI and other emerging technologies.

Africa

Outsourcing penetration among African countries increased in 2019, which brought the continent in line with the global average after years of trailing it. Outsourcing spending remains well below $1 billion in the continent, which has 19 Forbes® Global 2000 companies. South Africa serves as the major hub for providing outsourcing services, but it ranks 22nd in ISG’s objective, data-based Outsourcing Viability Index. Most of the other service delivery in Africa comes from countries in North Africa.