ISG Provider Lens™ Healthcare Digital Services - Payer Business Process as a Service - U.S. 2021

Healthcare in the U.S. continues to be a difficult course to navigate, whether one is a provider or a consumer of related services. A combination of the ongoing pandemic, changing regulations, technological advances, rising costs and new entrants mean the choppy waters will continue into 2022. All these factors point to a growing need for service providers, such as the ones in this study, to plan and deliver the digital transformation services vital for healthcare companies to land safely. The data reflects that growth assertion. The ISG Index measured through Q3 2021 for the U.S. Healthcare and Pharma sector, annual contract value bookings shows the combined markets of managed services and “as a service” up by 10% to US$3.6 billion in 2021.

Looking across the findings for this study, ISG notes several overarching changes/themes that drive or affect digital transformation in healthcare: the COVID-19 pandemic, valuebased care, information access and business model disruption. We discuss each below, identifying the associated uncertainties.

Learning from the COVID-19 pandemic, the U.S. healthcare system evolved in 2021, with increased focus on social determinants of health and healthcare equity, supply chain issues, workforce challenges, deferred/missed care and the long-term repercussions of COVID-19 on both patients and the healthcare ecosystem. Other uncertainties related to the pandemic include:

- Care complexity, including support for an increasing number of patients with chronic conditions that are not yet back to pre-pandemic conditions

- Unclear societal response to Delta, Omicron and other possible variants in the future

- Effects on balance sheets, assets and resources

- Insurance coverage and plan shifts

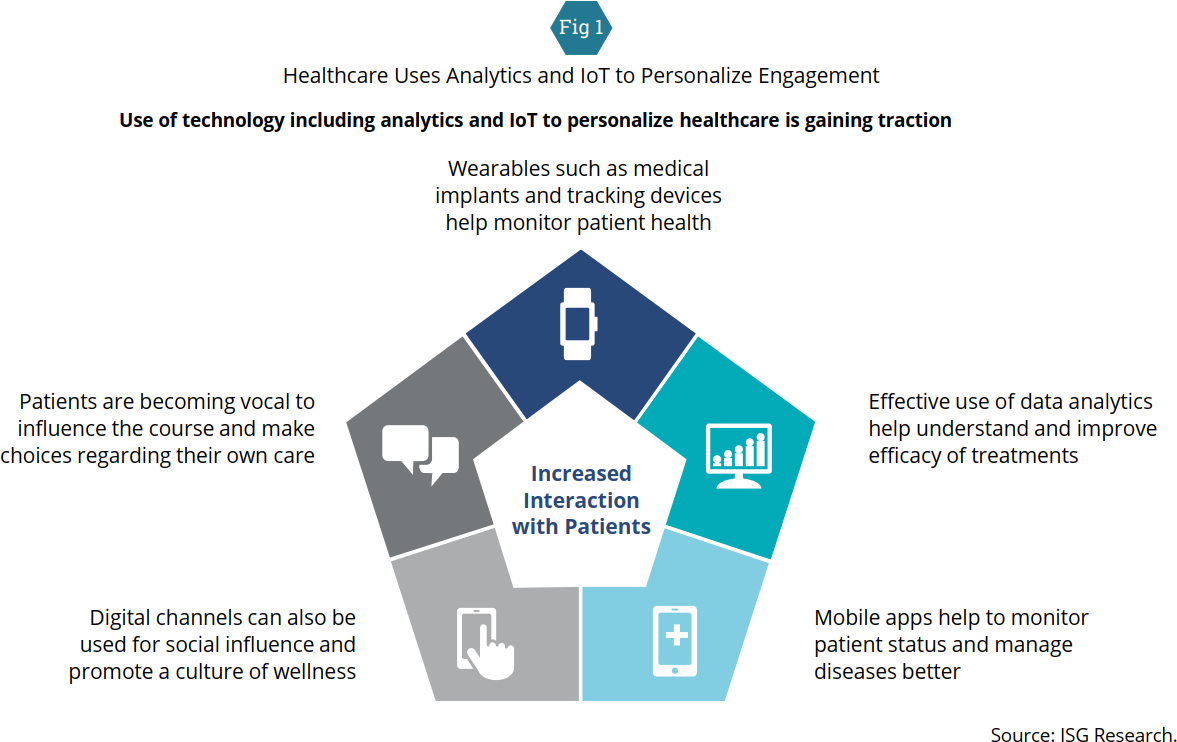

Value-based care continues to take center stage, with a growing focus on remote/virtual care, including telehealth. Related to this is the consumerization of healthcare, with more convenience and easy access to information and services. Concurrently, mental health issues have become more visible with growing recognition that healthcare needs to address the overall well-being of those affected, by considering physical as well as emotional well-being. Patient-centric care using digital tools continues to spread and gain significance, for both healthcare personalization and enhanced data collection. These tools are improving with the use of AI and real-time analytics, but they still need integration with in-person care (Figure 1). Another aspect of value-based care is the emergence of payment models not dependent on insurance such as the direct primary care model. Future uncertainties around value-based care include:

- Data-related issues, including transparency, privacy, algorithm bias and data fragmentation/consistency

- Equity of access for those with limited broadband or lack of modern connected technologies

- Delivery of care to an aging population

- Consistency of reimbursement for remote care

- Risk sharing between payers and providers

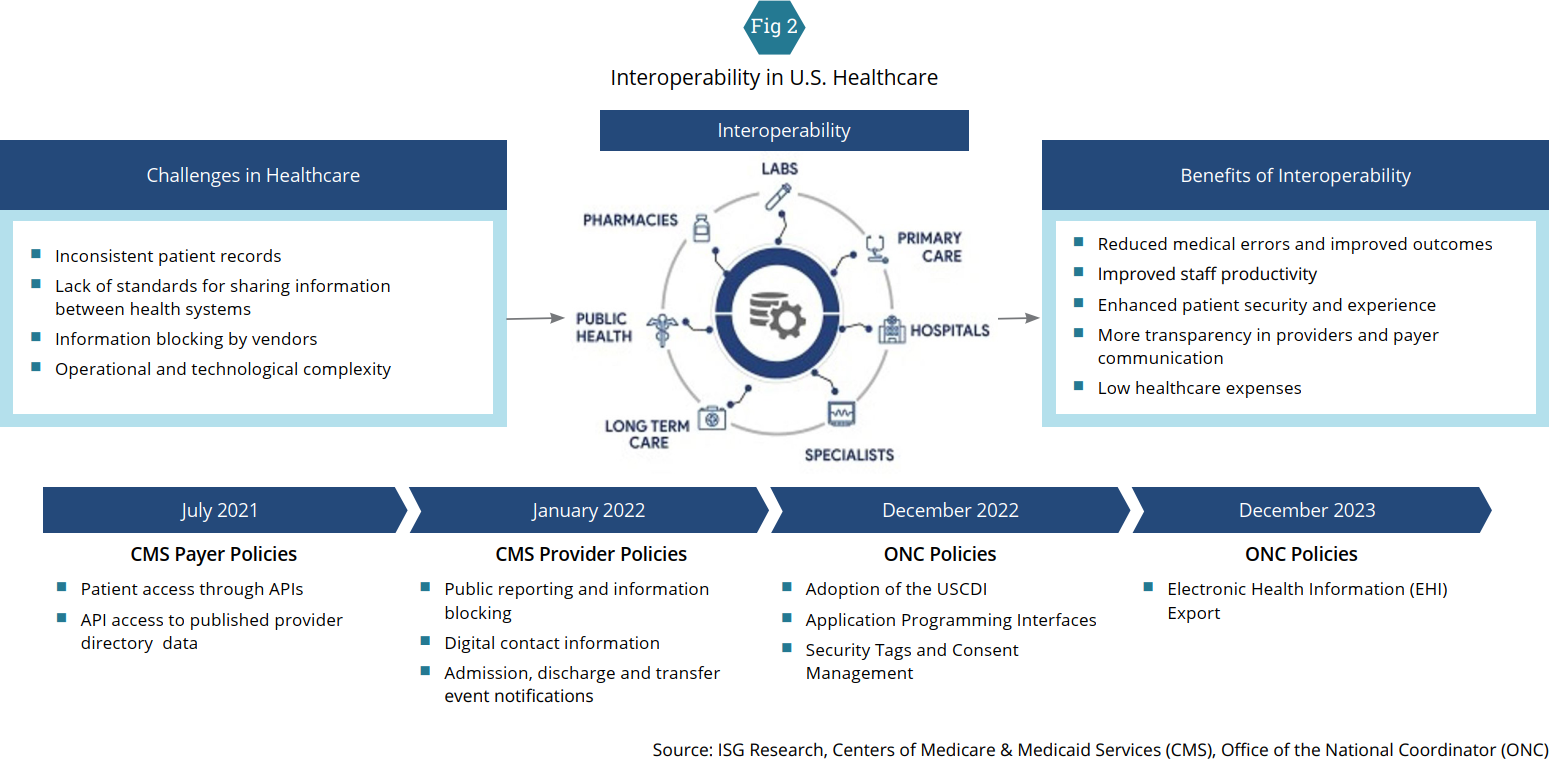

Wrapped up with the pandemic and value-based care is the need to access and share medical information that can help improve patient expectations and outcomes. In the U.S., the healthcare system is evolving to ensure cost transparency to consumers and enable improved access to medical data needed by the various stakeholders (including the patient) involved in patient care. The federal government has mandated some access and sharing regulations that rely on improving interoperability. In this study, ISG asked service providers about their interoperability services. Although these providers offer expert advice and tools, the uptake of interoperability services in 2021 was less than expected. The uncertainties that continue to plague interoperability are related to the following:

- The magnitude of regulatory oversight concerning the future of healthcare, at all government levels

- Enforcement of additional regulations and standards

- Clarification on government and industry requirements related to reporting and quality measures

- Access of legacy health tech solutions and data, some of which is moving to cloud platforms

The final category of major change in the healthcare ecosystem is the continuing disruption triggered by technology companies, retailers, telecom providers and banks, as well as consolidations via mergers and acquisitions. Basic primary care is being provided by big-box stores and pharma chains. Provider and employer arrangements with payers are changing the nature of partnerships with insurance companies, or "payviders" as they are now often described. Future uncertainties in the ecosystem include the long-term commitment of new entrants, the market responses to them, and the outcomes of the mergers and acquisitions.

The four categories of change (mentioned above) lead to the following challenges in digital transformation for payers and healthcare providers:

- Regulation: Government oversight, deadlines and modifications require significant attention. Payers and healthcare providers continue to modify business practices involving information exchange and delivery of electronic health information.

- Technology: Systems in healthcare reflect complexity, disparity, aging and disconnection. The result is fragmented patient member data that is untenable for digitization.

- Financial ambiguity: Demographic shifts and lifestyle changes are intensifying cost pressures on healthcare systems. The losses related to COVID-19, among hospitals and other healthcare providers, have been substantial. Payers find it difficult to predict their costs and revenue. All entities continue to search for operational cost takeout.

- Organization change management: Healthcare organizations resist change, avoid risks and suffer technical debt. The industry has complex processes and multifaceted product mixes. Another layer of risk management is related to privacy and security requirements and concerns

This study reveals that many service providers are available to help healthcare organizations with these challenges. The companies have the skills, industry expertise, tools and partnerships to assist in healthcare digital transformation. Across this cohort of service providers, the study affirms experience in several key areas:

- Business and engineering transformation: ISG notes that despite the availability of these services, healthcare clients focus predominantly on tactical versus strategic initiatives. Nonetheless, market dynamics are compelling healthcare payers and providers to reassess their roles, which is expected to lead to the engagement of more strategic services in 2022.

- Healthcare domains: Expertise is available in healthcare markets, care coordination, partnerships, platforms and technologies (including advanced/emerging ones). ISG sees that the healthcare market underestimates service provider capabilities. However, with growing awareness of market complexities, ISG expects healthcare companies to seek an increasing number of services from providers that understand and can help manage this complexity.

- Interoperability and integration: Service providers offer approaches and solutions that address the mandates and also go beyond to offer added value through their integration capabilities. Here, too, ISG notices that the market is slow in seeking services despite the existing mandates but expects demand to pick up momentum in 2022.

- Modernization: Technology solution modernization, replacement and cloud migration are among the fastest growing initiatives in the healthcare ecosystem. ISG observes that many healthcare organizations and service providers focus on the “digital front door” to give people access to services. Such apps and portals drive digital transformation activities built on existing and new infrastructures.

- Centers of excellence: Leading service providers for healthcare have centers of excellence that consolidate expertise, technology and research. Some offer centers of excellence for leading electronic health record (EHR) systems. ISG also sees large investments by service providers in next-generation tools and intellectual property, including patents, grants, frameworks, benchmarks and accelerators. Centers of excellence are innovating in areas such as the Internet of Medical Things (IoMT), automation, AI and analytics.

Access to the full report requires a subscription to ISG Research. Please contact us for subscription inquiries.